DSCR Refinance Loans: A Smarter Way for Real Estate Investors to Unlock Equity

For real estate investors, timing and flexibility matter. Whether you’re looking to lower your rate, pull cash out to fund your next deal, or restructure an existing loan, DSCR refinancing has become one of the most powerful tools in today’s investment lending landscape.

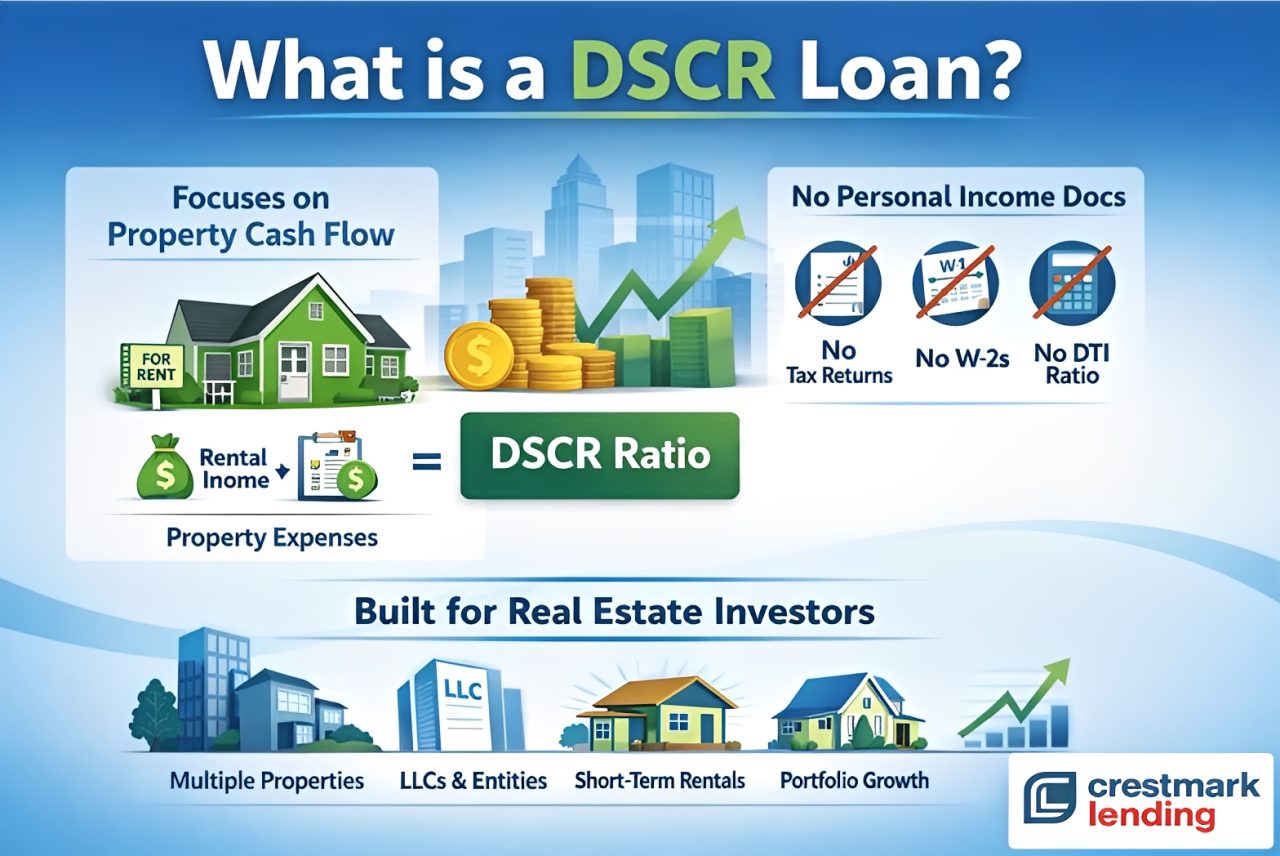

Unlike traditional mortgage refinancing, DSCR refinance loans are built specifically for income-producing properties — putting the focus on property cash flow, not your personal income.

Let’s break down how DSCR refinancing works, when it makes sense, and why more investors are choosing this strategy to scale their portfolios.

Why Investors Use DSCR Refinance Loans

DSCR refinancing isn’t just about lowering a rate — it’s about flexibility and growth. Below are the most common reasons real estate investors refinance using DSCR loans.

1. Cash-Out to Fund New Investments

Many investors use DSCR cash-out refinances to:

- Acquire additional rental properties

- Renovate or reposition existing assets

- Pay off higher-interest short-term debt

- Build liquidity without selling properties

Because DSCR loans rely on rental income, investors can often access equity without impacting DTI or personal borrowing power.

2. Refinance Without Tax Returns

Traditional refinances often require:

- Two years of tax returns

- Complex income write-backs

- Debt-to-income scrutiny

DSCR refinancing removes much of this friction, making it ideal for:

- Self-employed investors

- Investors using depreciation aggressively

- Portfolio landlords with complex finances

3. Refinance Properties Held in an LLC

DSCR refinance loans commonly allow properties to be held in:

- LLCs

- Corporations

- Trusts

This structure helps investors separate liability, streamline bookkeeping, and scale efficiently — something many conventional lenders restrict.

4. Stabilize Long-Term Financing

Investors often use DSCR refinancing to:

- Exit short-term bridge or hard money loans

- Lock in long-term fixed rates

- Improve cash flow and predictability

Once a property is stabilized and producing rent, DSCR refinancing becomes an effective long-term exit strategy.

DSCR Refinance vs. Conventional Refinance

| Feature | DSCR Refinance | Conventional Refinance |

|---|---|---|

| Based on rental income | ✔ Yes | ✘ No |

| Personal income required | ✘ Typically no | ✔ Yes |

| LLC ownership allowed | ✔ Yes | Limited |

| Property count limits | Minimal | Strict |

| Investor-focused | ✔ Yes | ✘ No |

For full-time real estate investors, DSCR loans are often the cleaner, faster, and more scalable option.

DSCR Refinance Loan Requirements (General Guidelines)

While programs vary by lender, most DSCR refinance loans follow similar guidelines:

Typically 660+

1.00+ preferred

- Rate-and-term: up to ~75%

- Cash-out: typically up to ~70%

- Single-family rentals

- Condos and townhomes

- 2–4 unit properties

- Multifami

When Does a DSCR Refinance Make Sense?

A DSCR refinance may be a strong fit if:

-

Your property is rented or market-rent ready

-

You want to pull equity without selling

-

Your tax returns don’t reflect strong income

-

You’re refinancing a bridge or short-term loan

-

You’re scaling beyond conventional loan limits

If your property cash flows — DSCR refinancing deserves a serious look.

Common DSCR Refinance Mistakes to Avoid

-

Focusing only on rate: DSCR loans involve pricing, fees, and prepayment terms — structure matters.

-

Ignoring rent assumptions: Market rent vs. in-place rent can impact DSCR calculations.

-

Working with non-specialists: DSCR lending is niche — experience matters.

This is where working with a DSCR-focused broker makes a real difference.

Why Work With Crestmark Lending for Your DSCR Refinance?

At Crestmark Lending, DSCR loans are all we do.

As a mortgage broker, we’re not tied to one bank or one set of guidelines. We shop your refinance across multiple DSCR lenders to find the best structure for your property, cash-flow goals, and long-term investment plan.

✔ Investor-focused guidance

✔ LLC-friendly lending

✔ Portfolio-level strategy

✔ Faster, smoother closings

Whether you’re refinancing a single rental or an entire portfolio, we help you make informed, strategic decisions — not just chase the lowest advertised rate.

Ready to Explore a DSCR Refinance?

If you’re considering refinancing an investment property, a DSCR loan could unlock flexibility, liquidity, and long-term growth without the red tape of traditional financing.

Connect with Crestmark Lending today to review your DSCR refinance options and see how your property’s cash flow can work for you.

This article was written by Ryan Collins of the Crestmark Lending team to help real estate investors understand how DSCR refinance loans work. It provides clear, practical insight into refinancing rental properties based on cash flow, unlocking equity, and structuring long-term financing for investment portfolios.