DSCR Refinance Loans: A Smarter Way for Real Estate Investors to Unlock Equity

DSCR refinance loans allow real estate investors to refinance rental properties based on cash flow—not personal income. Learn how DSCR

Home > DSCR Loans > Arkansas

Get Your DSCR Quote – No SSN Required

Qualify Based on Property Cash Flow — Not Personal Income

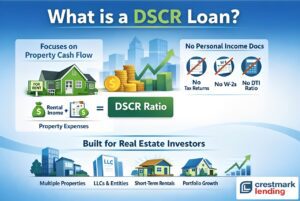

At Crestmark Lending, DSCR financing is built for real estate investors across Arkansas. We structure loans around rental property performance—not personal income or traditional DTI—so investors can move faster and scale with confidence. Our streamlined approach delivers the speed, flexibility, and clarity needed to compete in today’s Arkansas investment market.

Why Crestmark DSCR Financing Stands Apart

Unlike traditional lenders, Crestmark specializes exclusively in DSCR loans for investors, offering flexible guidelines, simplified documentation, and fast, predictable approvals for both purchases and refinances.

Built Specifically for Real Estate Investors

Crestmark Lending is a DSCR-focused mortgage broker serving investors across Arkansas. With faster approvals, streamlined underwriting, and access to dozens of national DSCR lenders, we deliver the pricing, flexibility, and speed investors need to grow and scale.

Designed for long-term rentals with 1–4 units and small multifamily buildings

Refinance your property to reduce payments or access equity

Flexible programs for multi-family properities- low rates, LTVs, and terms

LLC-owned investment properties, qualified by rental cash flow

DSCR financing for rental property upgrades and renovations

Build-to-rent financing with long-term DSCR takeout options

High-balance financing for larger rentals and experienced investors

Crestmark Lending works with over 20+ DSCR lenders, allowing us to secure competitive pricing, flexible guidelines, and the right loan structure for your investment strategy.

Trusted by Arkansas real estate investors for fast closings and reliable service.

We target closings in 21 days or less through a streamlined, start-to-finish process.

Lowest possible rates because we compare over 20 lenders across multiple wholesale DSCR programs

Investor-focused underwriting built to handle unique property types and complex transactions.

Whether you’re building your first rental or expanding a portfolio, we provide fast, investor-friendly DSCR financing for Arkansas properties with minimal documentation.

At Crestmark Lending, DSCR loans are our specialty. We offer fast approvals and flexible, investor-focused financing for clients who want a lender that understands how DSCR really works.

Production Manager

NMLS #2004549

Operations Manager

Sr. Loan Officer

NMLS# 2692859

Branch Manager

NMLS #2014728

Sr. Loan Officer

NMLS #1757471

In Arkansas, a DSCR loan is an investor-focused mortgage that qualifies based on a property’s rental income rather than personal income or tax returns. Lenders compare rental income to the monthly PITIA payment to calculate the Debt Service Coverage Ratio. If the income covers the payment, the property may qualify.

Typically in Arkansas, DSCR lenders look for a 660 credit score and a DSCR of at least 1.00. That said, some lenders offer flexibility with lower ratios when offset by strong credit, added reserves, or adjusted pricing.

Yes. In Arkansas, DSCR loans are designed specifically for real estate investors and can be closed in an LLC, corporation, or other business entity. As a result, investors can separate liability, maintain clean bookkeeping, and manage multiple rental properties under a single entity.

DSCR refinance loans allow real estate investors to refinance rental properties based on cash flow—not personal income. Learn how DSCR

DSCR loans make it easier to finance Airbnb and short-term rental properties by qualifying based on rental income — not

Learn what a DSCR loan is, how debt service coverage ratios work, and why real estate investors use DSCR loans

"*" indicates required fields

"*" indicates required fields

"*" indicates required fields

* Rates shown assume a purchase transaction.

* Annual Percentage Rate (APR) calculations assume a purchase transaction of a single-family, detached, owner-occupied primary residence; a loan-to-value ratio of less than 80% for conventional loans; a minimum FICO score of 740; and a loan amount of $300,000 for conforming loans, unless otherwise specified.

* Annual Percentage Rate (APR) calculations assume a purchase transaction.

* Rates may be higher for loan amounts under $300,000. Please call for details.

* Rates are subject to change without notice.

* Closing Costs assume that borrower will escrow monthly property tax and insurance payments.

* Subject to underwriter approval; not all applicants will be approved.

* Fees and charges apply.

* Payments do not include taxes and insurance.

* Assumes – 30 Day Rate Lock.

* Rates based on Texas property.

* Mortgage insurance is not included in the payment quoted. Mortgage insurance will be required for all FHA, VA and USDA loans as well as conventional loans where the loan to value is greater than 80%.

* Restrictions may apply.

* Lender Fees & Appraisal Fees may apply